China's Economic Downturn: A Closer Look at Their Market and Global Implications

China's Stock Market Crash

China's stock market recently experienced a severe downturn, marked by a 5% plunge that eradicated 500 billion in Chinese corporate equity. This crisis, resulting in a 25% decline over two years, stands in stark contrast to the performance of other major economies. While US stocks saw a 10% rise, British stocks remained stable, and Japanese stocks notably increased. This disparity underscores that the issue is specific to China, not a global trend.

The Roots of the Crisis

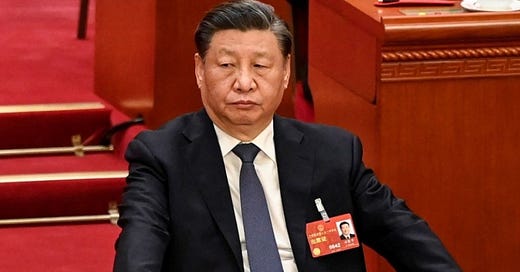

President Xi Jinping's economic strategies significantly impacted China's financial downturn. His administration shifted focus from a private sector-led to a government-managed economy. The Wall Street Journal describes this approach as a love-hate relationship with private companies, fueling uncertainty about China's economic future. This mismanagement has contributed to the current financial instability.

Beijing's Response

In response to the crisis, Beijing's state council initiated measures to stabilize the market. These interventions ranged from tax adjustments to banning short sales, and now potentially a 300 billion dollar rescue package, reminiscent of the 2015 strategy. However, analysts are skeptical about its effectiveness due to the long-term crippling of China's growth engine, particularly in the housing industry.

China’s Debt Crisis and Manufacturing Overcapacity

China's debt, over 300% of its GDP, poses a significant economic threat. This debt burden is aggravated by ongoing deflation and overcapacity in manufacturing sectors. The decline in housing prices further exacerbates the situation, as debts automatically inflate, adding to the economic strain.

Global Impact and Investor Sentiment

China's economic challenges have rippling effects on global markets. Investor confidence is waning, with a noticeable shift towards other emerging markets. Countries like Indonesia, Vietnam, and even Mexico are becoming more attractive to investors, while the US struggles to draw foreign investment due to domestic policy issues.

Future Scenarios and International Relations

Looking forward, China may increasingly move towards a nationalized economy. Foreign investors, wary of China's authoritarian policies and stagnant growth, are seeking safer investment havens. The 2024 US elections could play a pivotal role in shaping global economic relations, especially if there's a shift in domestic manufacturing policies.

China's stock market crash and the ensuing economic turmoil highlight the consequences of government mismanagement and over-reliance on debt. As Beijing scrambles to contain the fallout, the global economic landscape watches closely, with significant implications for international relations and investment trends in the years ahead.